Another myth pushed by drug advocates is “Let’s tax it and use the money to provide addiction services and build schools and hospitals and houses and (insert a great cause in here)…”

If alcohol and tobacco are any indication, tax revenue from marijuana sales will fall well short of the costs.

If alcohol and tobacco are any indication, tax revenue from marijuana sales will fall well short of the costs.

TOBACCO – A report published the Ministry of Health in 2016 estimated that the total cost of smoking to New Zealand’s health and welfare systems was $2.5 billion in 2014. Tobacco excise tax currently raises approximately $1.5 billion gross per year. A 2016 Treasury report stated that excess healthcare costs for smokers over non-smokers in New Zealand are almost $2 billion.

ALCOHOL – Alcohol-related harm in New Zealand has been recently estimated to cost approx. $5 billion per year. This equates to a cost of $14.5 million every day. Excise tax revenue from alcohol in 2016 was $661 million.

More recently, a University of Otago study found the “hidden cost” of alcohol to NZ workplaces alone is more than $1.65 billion per year

MARIJUANA – The marijuana industry is quick to (over)estimate large amounts of revenue from pot sales, but it rarely, if ever, discusses the societal costs of legalisation. Legalisation also results in administrative and enforcement costs, similar to alcohol regulation.

Other societal costs not referred to by drug supporters include: greater other drug use, greater marijuana use among underage students, property and other economic damage, controlling an expanded black market, sales to minors, public intoxication, and other burdens. No policy is without its costs. Legalisation will result in significant costs to society.

The Drug Foundation recently tried this exact argument.

But a fortnight later, a new study on the actual impact of marijuana legalisation in Colorado found that for every one dollar in tax revenue from marijuana, the state spends $4.50 as a result of the effects of the consequences of legalisation. The Colorado study used all available data from the state on hospitalisations, treatment for Cannabis Use Disorder (CUD), impaired driving, black market activity, and other parameters to determine the cost of legalisation – and because of the difficulty in calculating the cost of human addiction, is believed to be an underestimation of the true cost.

Other findings from the study included:

Other findings from the study included:

- costs related to the healthcare system and from high school drop-outs are the largest cost contributors

- while people who attended college and use marijuana has grown since legalisation, marijuana use remains more prevalent in the population with less education

- research shows a connection between marijuana use and the use of alcohol and other substances

- yearly cost-estimates for marijuana users: $2,200 for heavy users, $1,250 for moderate users, $650 for light users ($US)

- in 2016, the marijuana industry was responsible for approximately 393,053 pounds of CO2 emissions

And it doesn’t take a rocket-scientist to figure out the logic:

- Legalisation would drive prices down (decrease revenue)

- Lower prices would increase use and harm

- Tax revenue would be well lower than harm costs

- Regulation and tax administration costs would be high

- Tax evasion would be high

Trends have already surfaced in Colorado & Washington state, suggesting that, like tobacco and alcohol, costs outweigh revenues:

- Over half the pot money promised for drug prevention, education & treatment in Washington State never materialised.

- Bureaucracy consumes a significant portion of Colorado marijuana tax revenue.

“Colorado has a booming black market.”

U.S. Attorney for District of Colorado Bob Troyer – September 2018

Marijuana tax revenue comes up short.

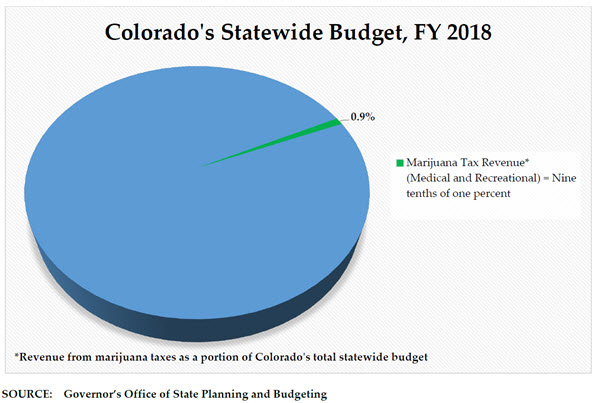

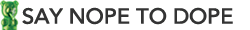

• Tax revenue from marijuana accounts for less than one percent of state revenues where the drug is “legal.”

• Almost every state that legalized marijuana came up short on initial revenue targets. In Massachusetts, the first year of tax revenue from marijuana sales was less than half of the anticipated $63M (Politico, 2019).

• Even as marijuana markets grow, research shows tax revenue quickly tapers off (Pew Trusts, 2019).

• Revenue projections are unreliable. As states seek to fill budget gaps, researchers advise against using marijuana tax revenue to fill long-term holes (Pew Trusts, 2019).

Will cannabis users suddenly line up to pay for a now taxed product? The ‘black’ or ‘grey’ market of prostitution, tobacco, alcohol and prescription drugs also continue as the most trafficked goods and services alongside the regulated industry, for the simple reason that people do not want to pay more or be regulated.

A report by the Washington Post last year argued that high taxes on legal marijuana in California could have the potential to turn many consumers away from the state’s cannabis shops and toward the black market. The credit rating agency Fitch Ratings warned; “The existing black market for cannabis may prove a formidable competitor to legal markets if new taxes lead to higher prices than available from illicit sources.” Colorado, Oregon and Washington all reduced tax rates after the commencement of legalization to shift customers back toward the legal market.

A report by the Washington Post last year argued that high taxes on legal marijuana in California could have the potential to turn many consumers away from the state’s cannabis shops and toward the black market. The credit rating agency Fitch Ratings warned; “The existing black market for cannabis may prove a formidable competitor to legal markets if new taxes lead to higher prices than available from illicit sources.” Colorado, Oregon and Washington all reduced tax rates after the commencement of legalization to shift customers back toward the legal market.

California’s projected marijuana tax revenue by July 2019 is nearly half of what was originally expected when the state began retail sales in 2018, since most consumers continue to purchase marijuana from the black market in order to avoid high taxes (Blood, 2019; Fuller, 2019).

Canadian government survey results released February 2020 found that 40% of the country’s marijuana consumers admit to having obtained the drug illegally since legalisation. Statistics Canada, a state agency, reports that just 29% of cannabis users buy all of their product from a legal source.

Here in New Zealand, drug advocates and media got excited when a Treasury official, in a document prepared for a brainstorming session, suggested the Government could save more than $500 million a year legalising marijuana. The report suggested tax from legal marijuana could be worth $150m, with annual savings of $400m from lower policing costs.

But researchers say that the alleged reduction in law enforcement and justice expenditure have not been realised overseas, with crime increasing and an increase in the costs of added regulation for non-compliance. Furthermore, the budget estimates do not cover the additional health and education on cannabis harms and the fact that the illegal drug trade will inevitably continue to thrive under more regulation and taxation. Drug dealers and other criminals who derive huge profits from the drug trade will not cease criminal activity in the face of legalisation. The costs of regulating and then policing that industry, will only compound the costs of policing the illegal market, as seen in Colorado.

“The perfect day will be when we don’t collect a cent from tobacco tax because nobody is smoking.”

Ex-NZ Prime Minister Helen Clark – March 2018

“The tax revenue collected from alcohol pales in comparison to the costs associated with it… Tobacco also does not carry its economic weight when we tax it… Though I sympathise with the current budget predicament and acknowledge that we must find innovative solutions to get us on a path to financial stability it is clear that the social costs of legalizing marijuana would outweigh any possible tax that could be levied. In the United States, illegal drugs already cost $180 billion a year in health care, lost productivity, crime, and other expenditures. That number would only increase under legalisation because of increased use.”

Gil Kerlikowske, President Obama’s Drug Czar, Why Marijuana Legalisation Would Compromise Public Health and Public Safety (2010).